Share this

Master Your Risk Management Strategies With Trading Simulator: Position Sizing and Diversification

Trading is not just about making profits; it's also about learning and adapting to the risks effectively. Whether you're a beginner or an experienced trader, the Trading Simulator is the perfect environment to practice essential risk management strategies, especially on tokens you're still deciding on, without the fear of losing real money. These strategies work for both short and long-term trading. Let’s dive into three crucial aspects of risk management—position sizing, setting stop prices, and diversification—using the simulated FDM token as examples.

Position Sizing: Managing Risk Per Trade

Position sizing determines how much of your portfolio to allocate to each trade. It helps you minimize risk by ensuring that no single trade has the potential to cause significant losses.

How to Apply Position Sizing

Set a risk percentage: For example, decide to risk only 2% of your portfolio on any single trade.

Calculate your position size: If your simulated portfolio is worth 10,000 USDS, you should risk no more than 200 USDS per trade.

Why It Matters

Position sizing ensures that even if a trade goes wrong, the impact on your portfolio is manageable. By practicing this using the Trading Simulator, you can develop a disciplined trading habit that will protect you from making losses in real-world trading.

Practical Example

Let’s say you’re holding 10,000 USDS in your Trading Simulator portfolio and decide to trade FDM tokens. If the FDM token price is 1 USDS per token and you’ve set a risk limit of 2% of your portfolio, you should only buy 200 FDM tokens for that trade. If the price drops, your maximum loss is capped, allowing you to recover and adjust your strategy.

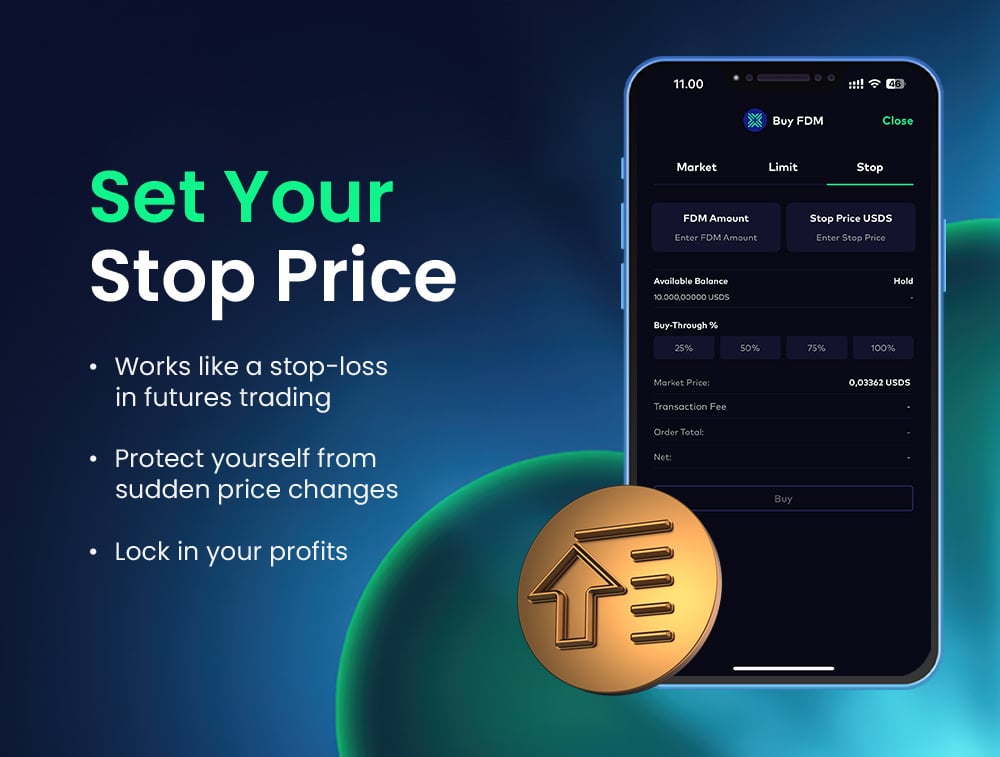

Set a Stop Price on Your Trades

Using a Stop Price feature can help protect your investments from unexpected market fluctuations. It works just like in futures trading, where leveraged positions often mean traders need to set a stop-loss level to protect their account from forced liquidation. Although there is no leveraged trading and liquidation risks on Trading Simulator, here’s how you can easily set a stop price when making your trades on Bitazza Trading Simulator.

- Open the Trading Panel: Navigate to the trading page and select the Stop option under the trading modes (Market, Limit, Stop).

- Enter your desired token amount

- In the amount field, specify the number of tokens you wish to buy or sell.

- Set the Stop Price (USDS)

From this column, you can manually enter the Stop Price (the price that will trigger the order) in USDS. For example, if you want to buy FDM when its price drops to a certain amount, you would set that as your Stop Price.

You can also choose to make orders by using a percentage of your available balance (25%, 50%, 75%, or 100%).

Review the Details and confirm your order. Check the Market Price, Transaction Fee, Order Total, and Net Amount to ensure the details are accurate.

Why Use a Stop Price?

Setting a stop price allows you to automate trades and control your exposure to market risk. For example:

- Protect Against Losses: If the market turns unfavorable, a stop price helps minimize potential losses.

- Secure Your Profits: You can set a stop price higher than your purchase price to lock in gains as the price rises.

Diversification: Spreading Your Risk

Diversification involves spreading your investments across various assets to reduce the impact of any single asset’s poor performance.

How to Diversify Your Portfolio

- Invest in multiple tokens, including BTC, FDM, ETH, and others.

- Balance between high-growth and stable assets to create a resilient portfolio.

Why It Matters

If you focus all your investments on one or two tokens and they perform poorly, your entire portfolio could suffer significant losses. Diversification protects your portfolio by ensuring that gains in one token can offset losses in another.

Practical Example

Imagine allocating your 10,000 USDS portfolio as follows:

- 30% in FDM as the utility token of the Bitazza platform.

- 30% in BTC: A relatively stable asset known as "digital gold."

- 20% in ETH: The leading platform for smart contracts.

- 20% in smaller altcoins: High-risk, high-reward assets.

By doing this, even if the altcoins underperform, your FDM, BTC, and ETH holdings can still stabilize your portfolio and minimize your losses by acting like an anchor.

Monitor Your Trading Performance with the Dashboard

A crucial part of risk management is keeping track of how your portfolio is performing over time. With the Trading Simulator Dashboard, you can regularly review your Profit and Loss (%PNL) performances for ongoing trades.

How to Monitor and Adjust

- Review Your Trades: Use the P&L data on the Dashboard to assess how each trade is performing.

- Exit Underperforming Trades: If a trade is consistently showing losses, consider exiting early to avoid further damage.

- Adjust Position Sizes: Based on your P&L, you can reduce your exposure to underperforming assets or increase it for better-performing tokens.

When diversifying your portfolio, FDM offers both utility and long-term growth potential, making it an essential part of any well-rounded strategy.

You can learn more about the FDM token

Read more about the FDM token benefits on Bitazza Global

Practice in a Safe Environment

The Bitazza Trading Simulator is your risk-free sandbox to experiment with various trading strategies. Test position sizing, explore diversification, and optimize your FDM usage to see how they impact your portfolio performance—all without risking real money.

Start your journey to becoming a more confident and disciplined trader today!

Enhance your trading skills with the Trading Simulator—join now and incorporate FDM into your strategy for greater success!

Share this

- February 2026 (2)

- January 2026 (4)

- December 2025 (13)

- November 2025 (6)

- October 2025 (10)

- September 2025 (8)

- August 2025 (17)

- July 2025 (29)

- June 2025 (13)

- May 2025 (14)

- April 2025 (12)

- March 2025 (8)

- February 2025 (8)

- January 2025 (8)

- December 2024 (7)

- November 2024 (5)

- October 2024 (14)

- September 2024 (9)

- August 2024 (14)

- July 2024 (3)

- June 2024 (48)

No Comments Yet

Let us know what you think