Share this

Bitazza 101: How to Trade on Futures Safely - Understanding the Dashboard

Futures trading offers tremendous opportunities for traders, but it also comes with inherent risks of losses and, in some cases, even liquidation. Before taking the dive into futures trading, it's important to first understand the trading interface on Bitazza, and how the various features like leverage adjustment, order types, and monitoring tools are all crucial to ensuring you're able to trade responsibly and keep your funds safe.

First, let’s explore the fundamentals through the Bitazza Futures trading interface, which you can access by tapping on the ‘Futures’ icon at the bottom of your screen. This feature is designed to simplify your trading experience while promoting safe practices.

1. Understanding the Futures Trading Interface

The Bitazza Futures interface is equipped with tools to help you place trades, specifically to buy and sell, monitor the order book, adjust leverage, and track active positions by tapping very few buttons. You will also see 2 distinct colors being represented here—green and red—which can also be simplified to mean buy and sell.

- Buy/Long: Use this option in green if you believe the price of the asset will increase.

- Sell/Short: Use this option in red if you expect the asset’s price to decrease.

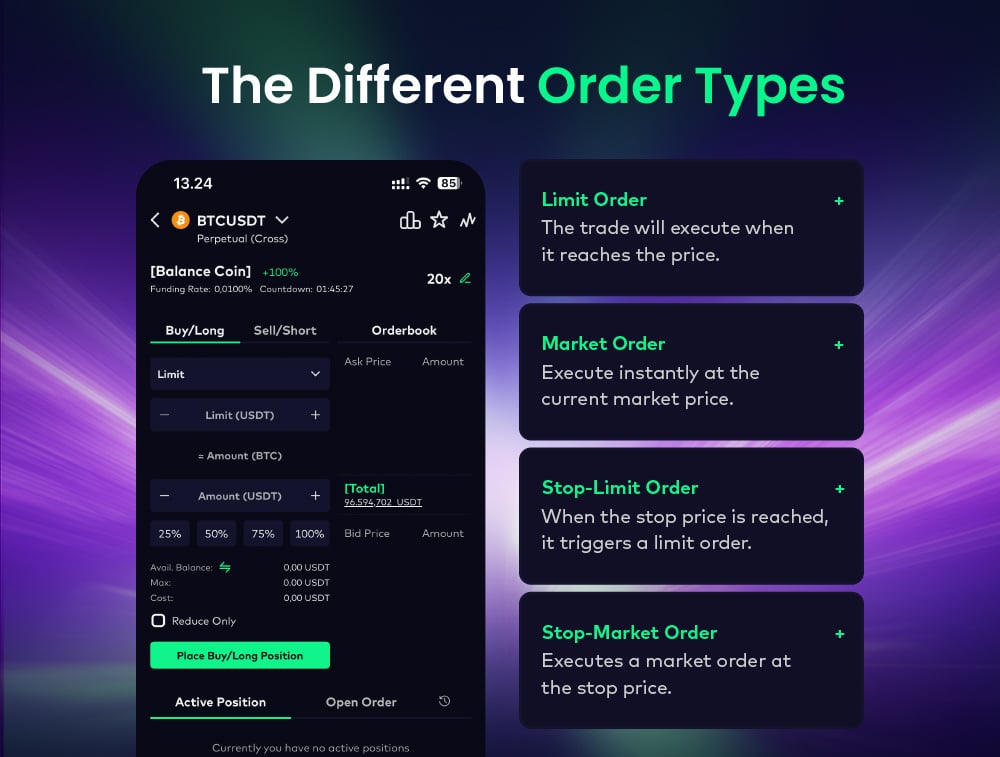

2. Order Types: Plan and Tailor Your Trades

Understanding the different order types available on futures trading is critical for managing your entry and exit points effectively. For example, if you’re looking for a short-term trade, you would likely use a Market order and conclude the trade as quickly as possible. However, for long-term trades, a Limit Order would make more sense as you could set a lower entry point to maximize your profit. Here are the various order types available on Bitazza.

- Limit Order: Set a specific price at which you want to buy or sell, and the order will be triggered once it reaches the price. Suitable for long-term trades, this option gives you greater control over your trade execution.

- Market Order: Execute your trade instantly at the current market price. Ideal for situations like short-term trading where timing is crucial.

- Stop-Limit Order: Combines a stop price and a limit order. This option will trigger a limit order at your specified price, helping you to lock in profits or minimize losses especially in a volatile market environment.

- Stop-Market Order: Executes a market order when the stop price is reached, ensuring quick exits to manage risks.

3. Leverage Adjustment: Amplify with Care

Futures trading allows you to amplify your trades by using leverage. You can adjust the leverage slider on the top right of your screen to set the desired level of leverage, up to 125x on selected pairs.

Caution: Higher leverage can leader to greater losses. Use responsibly.

4. Order Book Insights

The Order Book on the right of the screen displays in real-time, the selling and bid prices of that particular token pair:

Ask Prices (Red): Sellers' demands.

Bid Prices (Green): Buyers' offers.

You can generally observe the movements here to assess market depth and liquidity of that particular token pair before placing a trade.

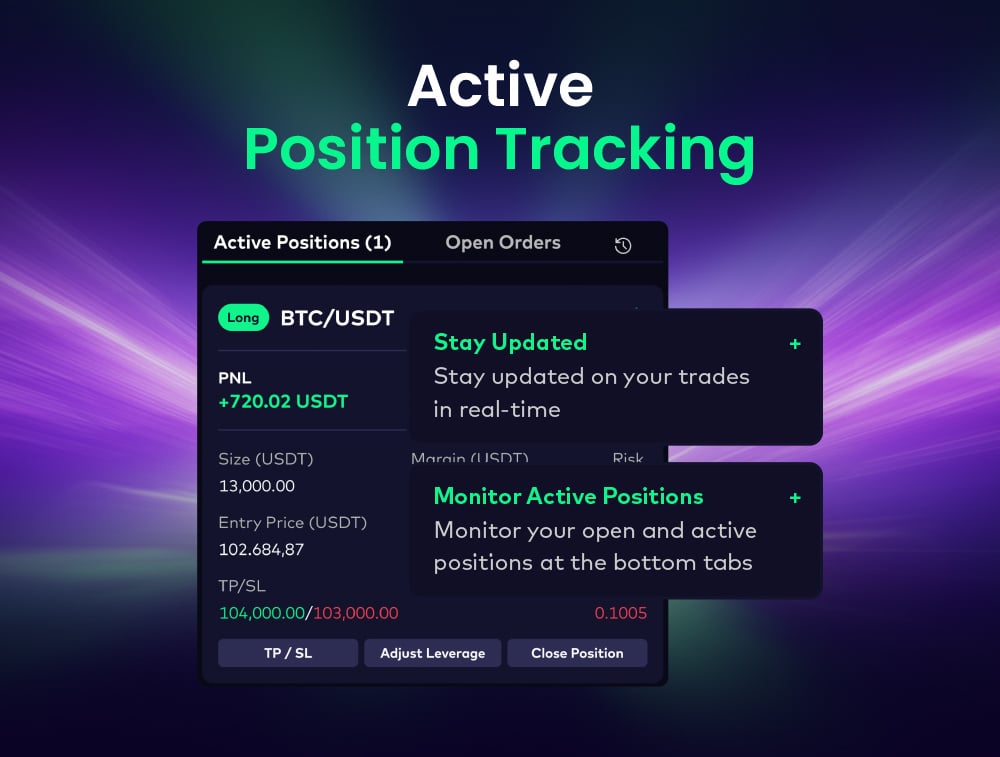

5. Managing Active Positions

Track your open positions at the bottom of the interface under “Active Positions.” Regularly monitor your trading performance and adjust your strategy as needed. The market is generally unpredictable, therefore be cautious when you open more than one trading position and stay updated in real-time.

Why Safety Matters in Futures Trading

Futures trading involves higher risks to your funds compared to spot trading. To trade safely:

- Use appropriate position sizing to limit your exposure.

- Diversify your trades across different assets.

- Monitor Profit and Loss (P&L) to stay informed about trade performance.

Bitazza’s intuitive interface and risk management tools make futures trading more accessible while emphasizing safety. Practice these strategies today to become a disciplined and informed trader.

Alternatively, you can also try out Bitazza Trading Simulator which offers all the benefits of trading with the use of virtual funds, making it a completely risk-free trading experience for you.

Learn more about Trading Simulator here: https://blog.bitazza.com/blog/the-tools-in-bitazza-trading-simulator

Share this

- February 2026 (6)

- January 2026 (4)

- December 2025 (13)

- November 2025 (6)

- October 2025 (10)

- September 2025 (8)

- August 2025 (17)

- July 2025 (29)

- June 2025 (13)

- May 2025 (14)

- April 2025 (12)

- March 2025 (8)

- February 2025 (8)

- January 2025 (8)

- December 2024 (7)

- November 2024 (5)

- October 2024 (14)

- September 2024 (9)

- August 2024 (14)

- July 2024 (3)

- June 2024 (48)

No Comments Yet

Let us know what you think